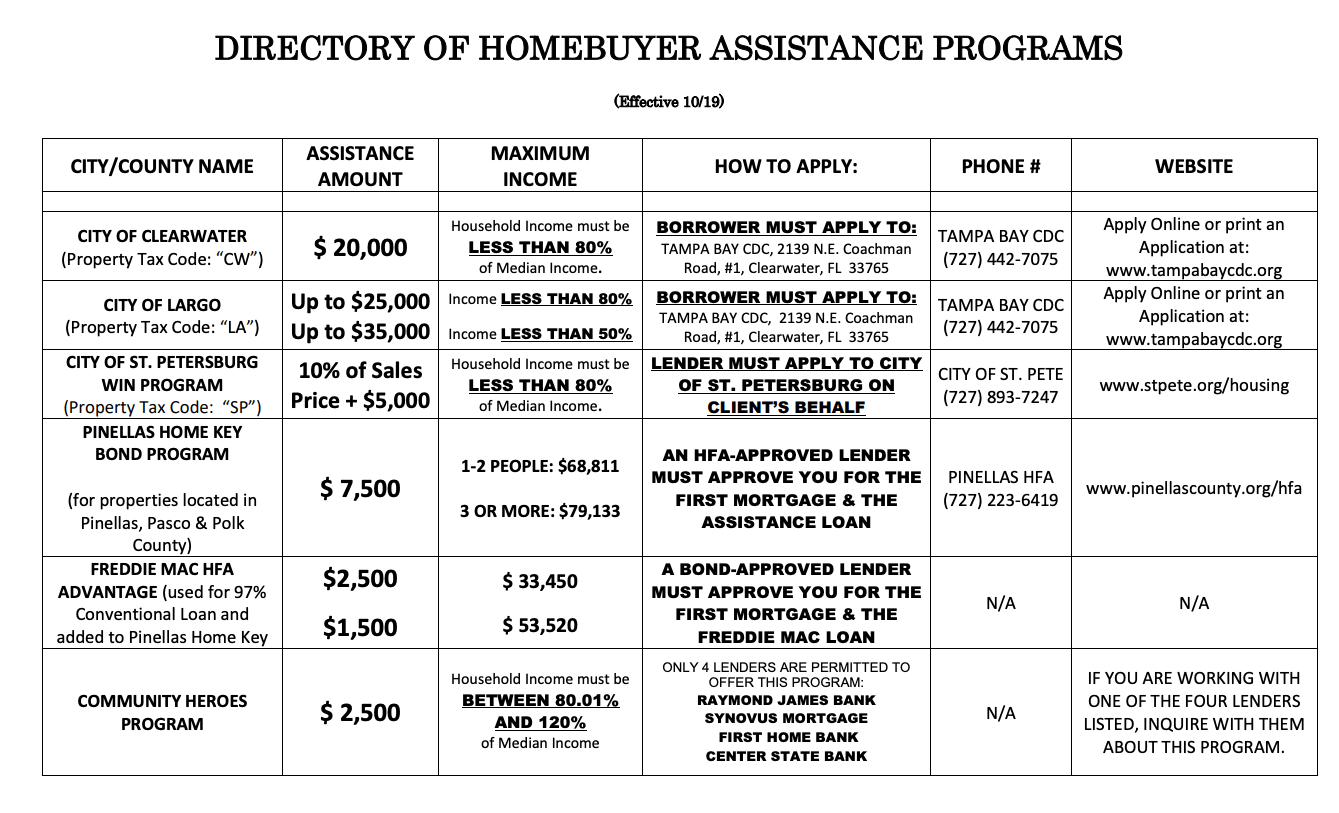

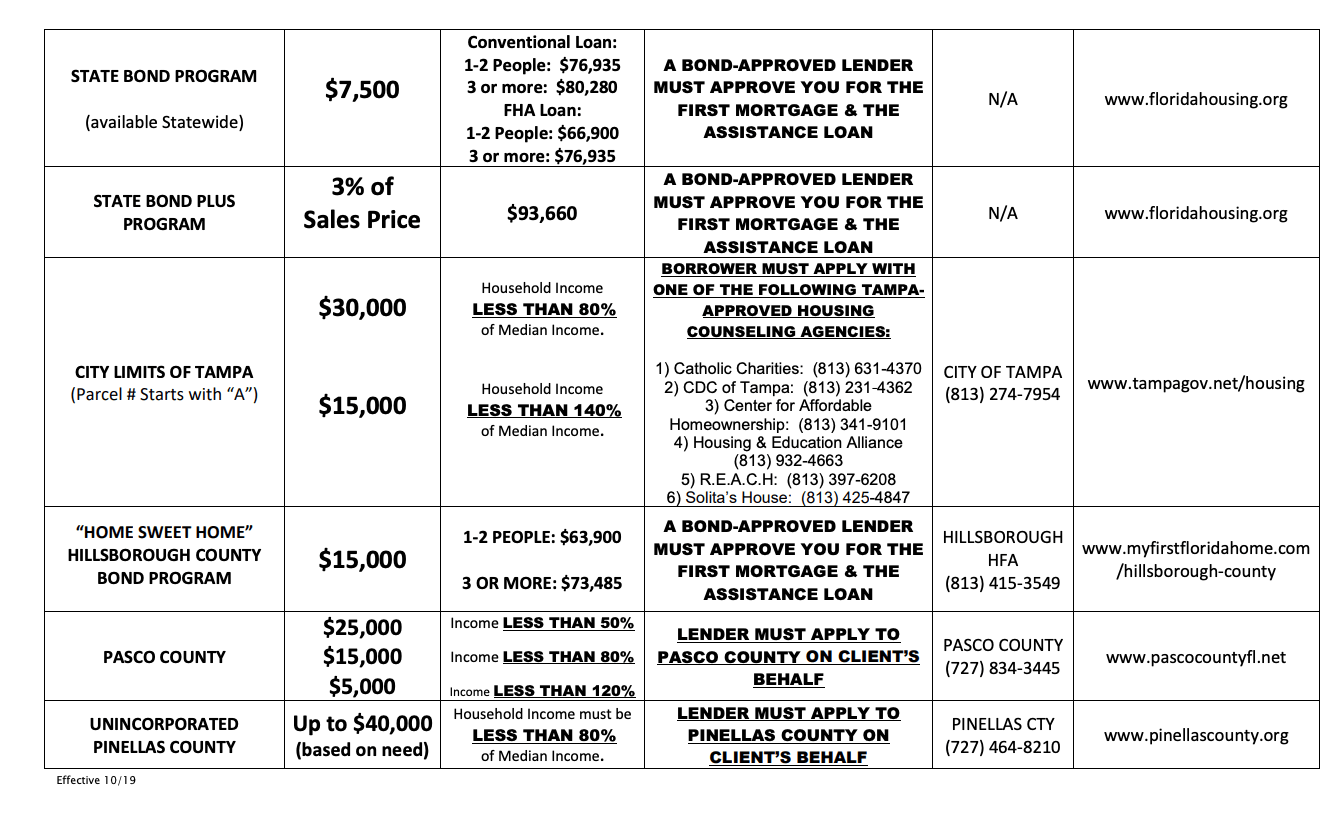

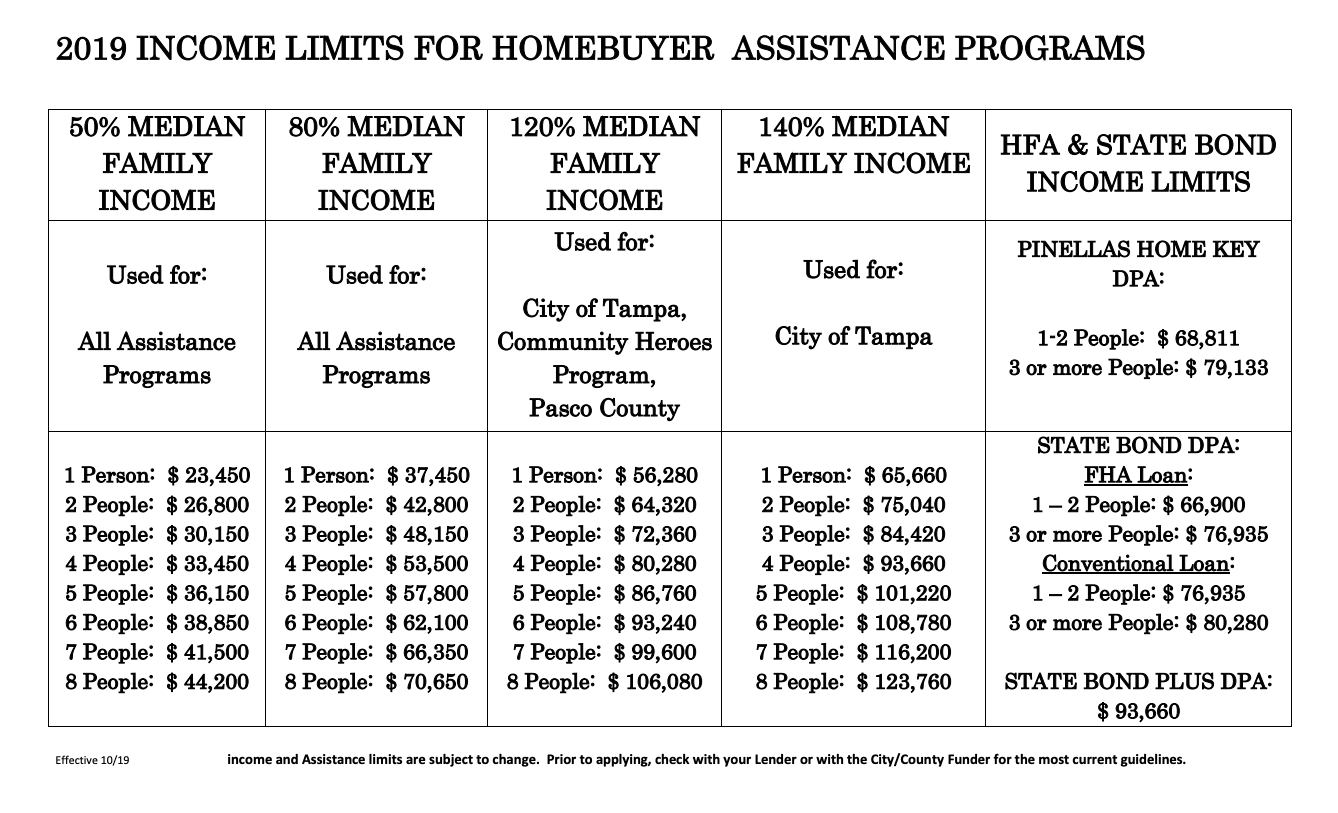

Check out the programs and contact Birch Real Estate Services today so we can help you claim your down payment money and achieve your goal of homeownership!

Home Buyers Assistance Programs

Borrowing money to buy a home is a big deal, so it’s natural to feel a bit overwhelmed.

Let's get started by learning some of the types of loans & programs available…

FHA loan : This is the go-to program for many first-time home buyers wanting a low down payment and/or have lower credit scores. The Federal Housing Administration allows down payments as low as 3.5% for those with credit scores of 580 or higher. The FHA will insure loans for borrowers with scores as low as 500 but requires a 10% down payment for a score that low. Mortgage insurance is required for the life of an FHA loan and cannot be canceled.

VA loan : The U.S. Department of Veterans Affairs helps service members, veterans and surviving spouses buy homes. VA loans are especially generous, providing competitive interest rates, often requiring no down payment or mortgage insurance. Although there is no official minimum credit score, a credit score of 640 or higher is what most VA-approved lenders require.

USDA loan : 100% financing on rural properties. This one may surprise you. The U.S. Department of Agriculture has a home buyers assistance program. And no, you are not required to have to live on a farm. The program targets rural areas and allows 100% financing by offering lenders mortgage guarantees. There are income limitations, which vary by region.

Fannie and Freddie Conventional loans : Conventional loans are best suited for people with high credit scores and because they are less risky to the lender they offer the lowest fees and best interest rates. With a higher down payment of 20% no mortgage insurance is needed. Fannie and Freddie are government sanctioned companies that work with local mortgage lenders to offer some appealing options on conventional loans, such as 3% down payments and either 30 or 15 year terms. Fixed and Adjustable rates are available to best suit your payment needs and qualifications.

.

Home renovation loans : Looking to Buy a Fixer Upper - this might be the perfect option

• FHA 203(k) loans, designed for buyers who want to tackle a fixer-upper. This special FHA-backed loan considers what the value of the property will be after improvements and allows you to borrow the funds to complete the project as part of your main mortgage.

• The CHOICERenovation loan is a conventional loan program through Freddie Mac that allows you to finance the purchase of a home and the cost of improvements, with low down payments.

First time homebuyer programs : National, state and local governments offer assistance to first time home buyers. You may qualify for these programs even if you've owned a house before. It's worth your time to gain more information if one of these programs will work for you.